Award-winning PDF software

3. 4. streamlined sales tax certificate of exemption 6. 2. 1.

TGB Form F0006 Exemption Certificate (Revised 1/31/18). All these certificates require a “Tax Notice” within the specified time period which must include the applicant's name, address, SS), TIN and the type of certificate requested. Tax Notice: For those with no SS# or TIN, if this is the first application, the tax notice should include your name, address, and SS#/TIN. For those with no SS number or TIN, the IRS issued Tax Notice number and name in order to verify their name and address is valid and correct. TIN: For those who do have a TIN, that is a five-digit number found on the left-hand side of a driver license. This is used to determine the individual's foreign tax status. A TIN is only a temporary measure to help verify a person's identity before establishing tax liability. The IRS does not have a way to verify a person's permanent TIN. TIN is issued.

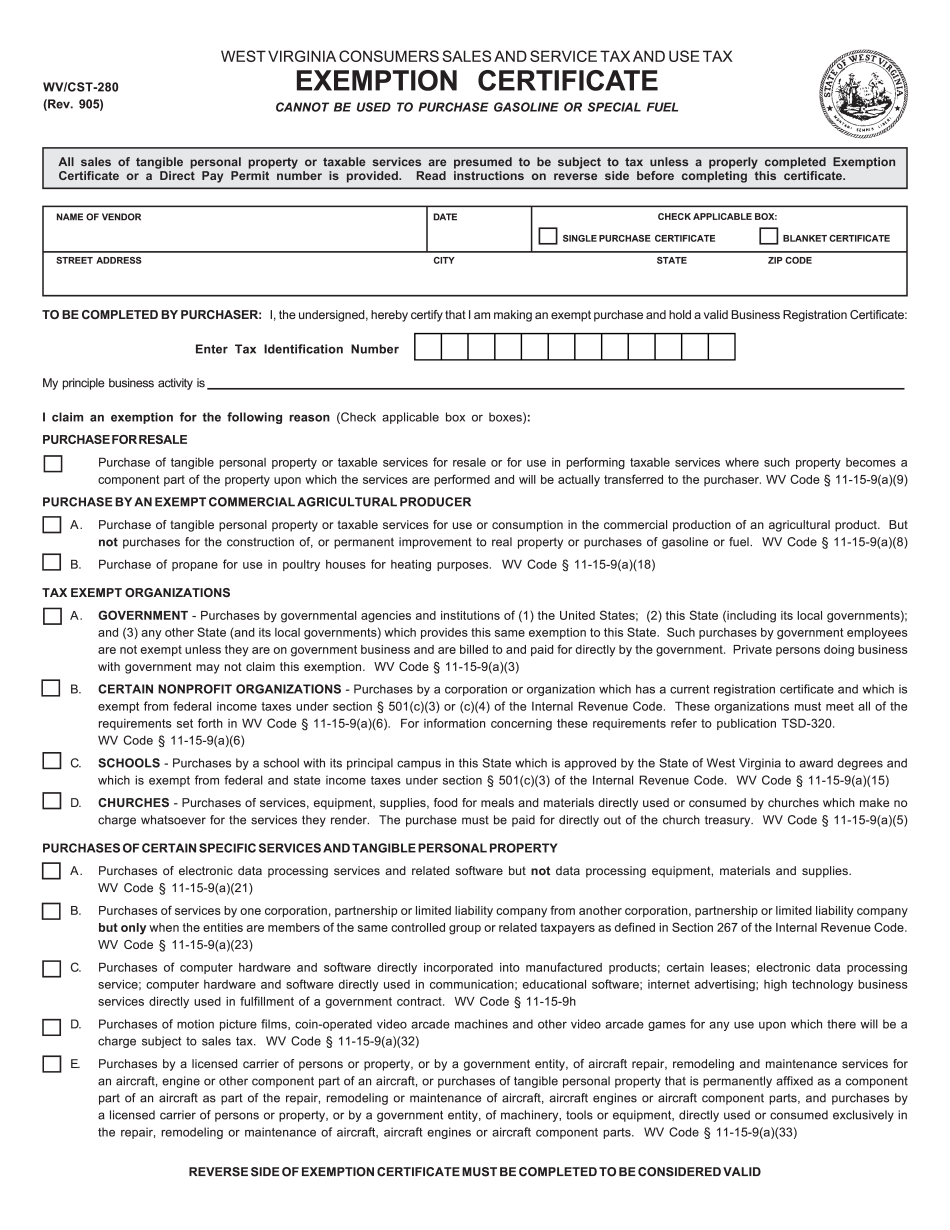

sales and use tax exemptions west virginia state tax

These exemptions do not require state or local documentation of exempt status and thus are commonly used for gifts to religious denominations who do not otherwise need to be taxed and are exempt from federal income taxes. In the context of corporate taxes, the term allows businesses to claim exemptions from corporate and franchise taxes as a percentage of profit rather than per unit. This is useful if the corporation or franchisee is a sole proprietor and would only be subject to state corporate income tax if they were to be “substantially” owned by an owner, such as an individual, or if all but one of the corporation's activities were related to its real estate investments. For more information about these exemptions, please contact the state income tax department that will be issuing the exemption document. Example 1: A corporation that owns land in the state where it is incorporated owns a.

Sales and use tax

No sales tax shall be imposed on the sale of services. If there is the option to pay by bank draft, check, credit card or other payment instrument payable to the State or an agent authorized by the State to give payment, it is presumed that such payment is for the purpose of obtaining or acquiring a ticket to attend an event at an amusement resort, as defined hereinafter, and the sales tax may be charged only on those quantities of such goods and services that are actually sold. It is not permissible to charge taxes on services rendered by one person to a third party on his own account when such services are reasonably expected to be rendered to such third party in the future by the owner of such goods in the capacity of a business associate (as defined herein) or as an employee of such third.

Forms - west virginia state tax department - wv.gov

Tax Information and Assistance (TIP) Division. Information to be furnished to taxpayers with respect to the following: The requirements for an initial tax return and refund. Information about nonresident aliens. The due date for the first tax return. The due date for filing any tax return. Any other information required by law. Virginia Tax-Free Savings Account (FSA) Application Application for TFS As. (Form TTFS-11). Virginia Department of Revenue website. The following tax-free savings account (FSA) providers may be used with this form: Direct deposit: Federal banking institutions and savings and loans associated with the account and any deposits held at that institution. State savings and loan association (SMA) and nonmember state or federal government savings and loan association (SMA) accounts authorized under the Financial Institutions Reform, Recovery, and Enforcement Act of 1989, as amended, as amended (FIR REA), and other financial accounts managed and insured by the State of Virginia.

exemption certificate - what is gsa smartpay?

Organization 501(c)(3) is a public charity in the state of West Virginia. Tax The organization may deduct contributions up to the amount specified in the form. Forms and Online Disbursements 501(c)(3) may be filed with: The Internal Revenue Service 1000 Pennsylvania Ave., NW Washington, DC 20016 File Form W-4. 501(c)(3) organization must keep a complete payroll account for all members in a “separate and distinct account” to avoid an increase in tax liability. (W. Va. Code, §) A complete list of expenses and payments due may be found in W. Va. Code § 20-31-7. Form W-4 — Form W-3 & Form W-2 Other resources How can I get certified? There are now a few organizations that provide 501(c)(3) certification for WV clients. 1. West Virginia C4 Association. West Virginia C4 is an organization that seeks to provide certification and education to individuals and businesses in West Virginia and around the world in the field of political and social movements. To qualify for certification, individuals and businesses.