Okay guys this video is to help you get tax-exempt in Home Depot. The in the description box below you have a link to the Home Depot website that you're looking at right now, and you'll have a bunch of other things down there such as the phone number where you can call Home Depot if you have any further questions, or you know message me you'll also have some states in there those are the states that you are going to try to get multi-jurisdictional exemption from. We're going to have other states that will be the states that Home Depot does not allow you to get tax-exempt in and for those states you will go back to one of my previous videos and for drop-shipping purposes only you were going to create shipping rate tables that will help you not lose money when someone purchases items from you in certain states there will be a surcharge added on to certain states as they try to purchase from you so anyway let's get started with this I'm going to go through it as smoothly as I possibly can. I did have to make a few phone calls and that's why I left the number down there for you guys as well as you know you can see it right here on the website when you get there if you have any questions so the first thing we're going to do is check this box. I have read and agree to the terms and conditions which most of you probably won't do it so but either way continue on okay. Over here to the right state tax ID number this seemed all perfect and easy when I started doing it I thought okay I'll just go ahead and select my...

PDF editing your way

Complete or edit your wv tax exempt form 2022 anytime and from any device using our web, desktop, and mobile apps. Create custom documents by adding smart fillable fields.

Native cloud integration

Work smarter and export wv tax exempt form directly to your preferred cloud. Get everything you need to store, synchronize and share safely with the recipients.

All-in-one PDF converter

Convert and save your blank wv tax exempt form as PDF (.pdf), presentation (.pptx), image (.jpeg), spreadsheet (.xlsx) or document (.docx). Transform it to the fillable template for one-click reusing.

Faster real-time collaboration

Invite your teammates to work with you in a single secure workspace. Manage complex workflows and remove blockers to collaborate more efficiently.

Well-organized document storage

Generate as many documents and template folders as you need. Add custom tags to your files and records for faster organization and easier access.

Strengthen security and compliance

Add an extra layer of protection to your wv tax exempt form printable by requiring a signer to enter a password or authenticate their identity via text messages or phone calls.

Company logo & branding

Brand your communication and make your emails recognizable by adding your company’s logo. Generate error-free forms that create a more professional feel for your business.

Multiple export options

Share your files securely by selecting the method of your choice: send by email, SMS, fax, USPS, or create a link to a fillable form. Set up notifications and reminders.

Customizable eSignature workflows

Build and scale eSignature workflows with clicks, not code. Benefit from intuitive experience with role-based signing orders, built-in payments, and detailed audit trail.

Award-winning PDF software

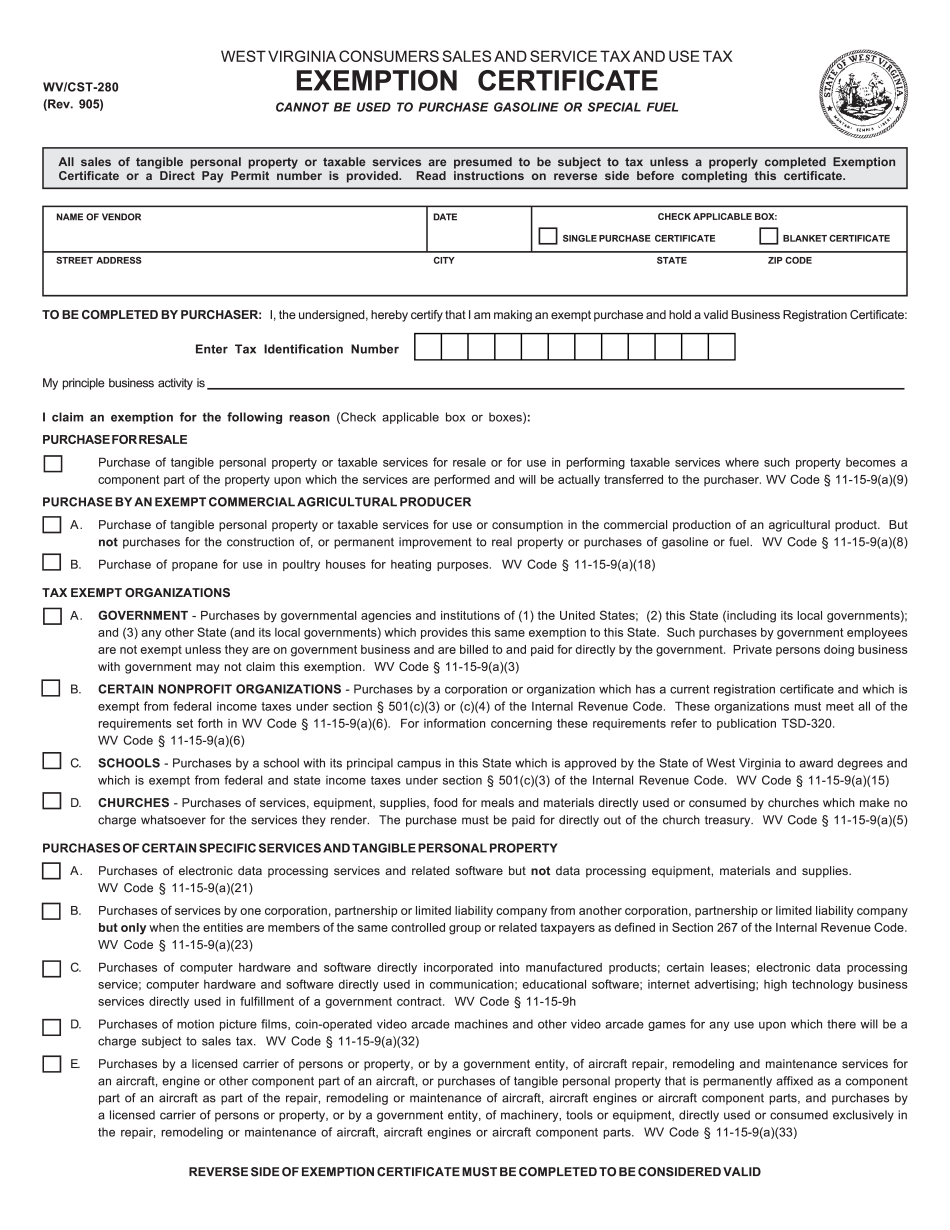

How to prepare Wv Tax Exempt Form

About Wv Tax Exempt Form

WV Tax Exempt Form refers to the West Virginia Tax Exemption Certificate. It is a document issued by the West Virginia State Tax Department to certain organizations or individuals, exempting them from paying the state's sales and use tax for qualifying purchases. The WV Tax Exempt Form is typically required by nonprofit organizations, government entities, religious institutions, educational institutions, and other qualified entities that are eligible for tax-exempt status under the state's laws. These organizations usually engage in activities that promote charitable, educational, or religious purposes and are exempt from state sales tax on purchases made for their exempt mission. By presenting the WV Tax Exempt Form to vendors or sellers at the time of purchase, eligible organizations can avoid paying sales tax on qualifying goods and services. This exemption helps these entities allocate their financial resources more effectively towards fulfilling their exempt purpose, rather than paying unnecessary taxes. It is important to note that the WV Tax Exempt Form does not automatically qualify an organization for federal tax exemption. Separate documents and requirements are necessary to obtain federal tax-exempt status from the Internal Revenue Service (IRS).

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Wv Tax Exempt Form, steer clear of blunders along with furnish it in a timely manner:

How to complete any Wv Tax Exempt Form online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our Assistance team.

- Place an electronic digital unique in your Wv Tax Exempt Form by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Wv Tax Exempt Form from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

What people say about us

Mistakes cost a penny

Video instructions and help with filling out and completing Wv Tax Exempt Form